Which of the Following Statements Concerning Taxation Is Accurate

Corporations pay federal and state income taxes. I1000 - If 1000000 of 8 bonds are issued at 101 12 the amount of cash received from the sale is.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

Income Statement Definition Uses Examples

Which of the following are examples of the due diligence that a practitioner must.

. Multiple Choice It varies inversely with changes in market interest rates. Please select one of these answers. It will generally exceed the cost of equity if the.

Partnerships pay state income taxes but not federal income taxes. Only the owners must pay taxes on corporate income. Which of the following statements concerning taxation is accurate.

Indicate the amount of dividends that would be subject to taxation if they filed a joint tax return. Question 31 Which of the following statements concerning taxation is accurate. Corporations pay federal income taxes but not state income taxes.

A Taxpayers need not include realized income in gross income unless a specific provision of the tax code requires them to do so. Corporations pay income taxes but their owners do not. One of the main disadvantages of the corporate form is.

Looking at all federal taxes the Congressional Budget Office shows that the top 1 percent pay an average federal tax rate of 333 percent. BCorporations pay income taxes but their owners do not. Option c Corporation pay federal and state income taxes.

C Once income is realized it cannot be excluded from gross income. Corporations pay federal and state income taxes. Which of the following statements regarding performing due diligence by a tax practitioner is not accurate.

Corporations pay income taxes but their stockholders do not. Which of the following statements concerning taxation is accurate. Corporations pay federal income taxes but not state income taxes.

IT - If the market rate of interest is 7 the price of 6 bonds paying interest semiannually with a face value of 300000 will be. Which of the following statements concerning taxation is accurate. Corporations pay federal and state income taxes.

AOnly the owners must pay taxes on corporate income. Corporations pay federal and often state income taxes. A practitioner must exercise due diligence.

Which of the following statements regarding the aftertax cost of debt is accurate. Corporations pay federal and state income taxes. Only the stockholders must pay taxes on corporate income.

Only the owners must pay taxes on corporate income. It will generally equal the cost of preferred stock if the tax rate is zero. Corporations pay income taxes but their owners do not.

Which of the following statements concerning taxation is accurate. DCorporations pay federal and often state income taxes. B Corporations pay federal income taxes but not state income taxes.

I think its B. Corporations pay federal income taxes but not state income taxes. Seattles City Council and Mayor are facing a reckoning after a 5-year long binge of leftist sentimentality that culminated with the passage of.

Which of the following statements concerning taxation is accurate. Corporations pay federal and state income taxes. Corporations pay federal and state income taxes.

Corporations pay federal income taxes but not state income taxes. Corporations pay federal income taxes but not state income taxes. Corporations pay federal and state income taxes.

Only the owners must pay taxes on corporate income. Partnerships pay provincial income taxes but not federal income taxes. Corporations pay federal income taxes but not state income taxes.

Which of the following statements concerning taxation is accurate. Corporations pay federal and state income taxes. Only the owners must pay taxes on corporate income.

The corporation is taxed on its earnings profits and the shareholders and taxed again on the dividends they receive from those earnings Option d paid in capital in excess of common stock. A Corporations pay federal and state income taxes. Which of the following statements regarding realized income is true.

Which of the following statements concerning taxation is accurate. Corporations pay income taxes but their stockholders do not. The following dividends were received by a husband his wife and both of them jointly.

Only the owners must pay taxes on corporate income. Confirming a taxpayers and spouse if applicable identity is not the tax practitioners responsibility. Corporations pay federal income taxes but not state income taxes b.

Corporations pay federal and provincial income taxes. Corporations pay federal income taxes but not state income taxes. Only the owners must pay taxes on corporate income.

Corporations pay income taxes but their owners do not. Up to 25 cash back Which of the following statements concerning taxation is accurate. B Realized income requires some type of transaction or exchange with a second party.

Partnerships pay state income taxes but not federal. CCorporations pay federal income taxes but not state income taxes. It is unaffected by changes in the market rate of interest.

Corporations pay income taxes but their owners do not. Which of the following statements concerning taxation is accurate. Option c double taxation.

Corporations pay federal income taxes but not provincial income taxes. The data shows tax rates decline with income and the. Income trusts pay federal and provincial income taxes.

Only the stockholders must pay taxes on corporate income. Which of the following statements concerning taxation is accurate.

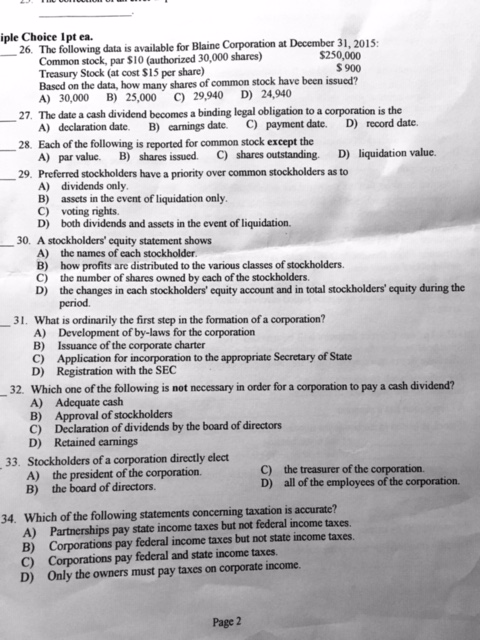

Solved Iple Choice Ipt Ea 26 The Following Data Is Chegg Com

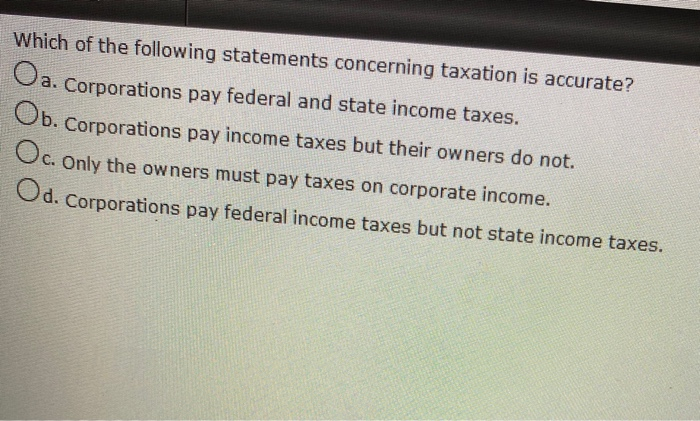

Solved Which Of The Following Statements Concerning Taxation Chegg Com

Accounting Principles That Are Essentials To Understand

Accounting Principles That Are Essentials To Understand

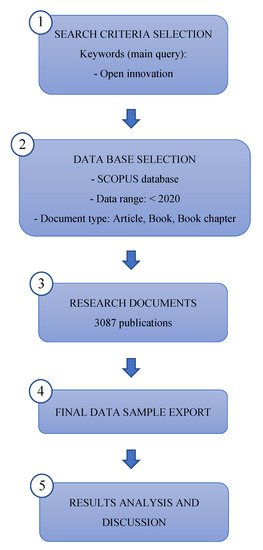

Sustainability Free Full Text Open Innovation For Sustainability Or Not Literature Reviews Of Global Research Trends Html

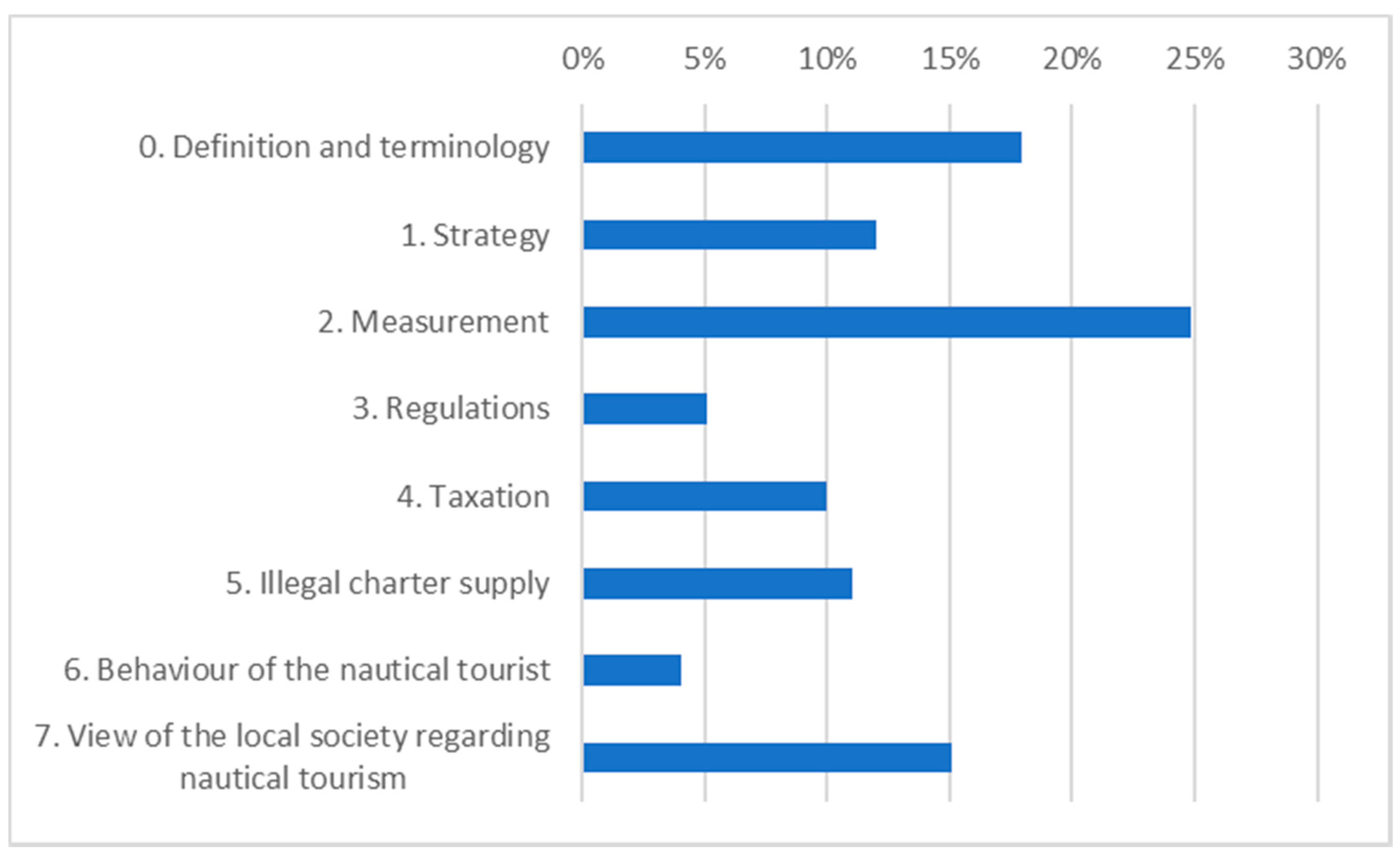

Sustainability Free Full Text Fostering Nautical Tourism In The Balearic Islands Html

What To Know About Covid 19 And Your Taxes 2022 Turbotax Canada Tips

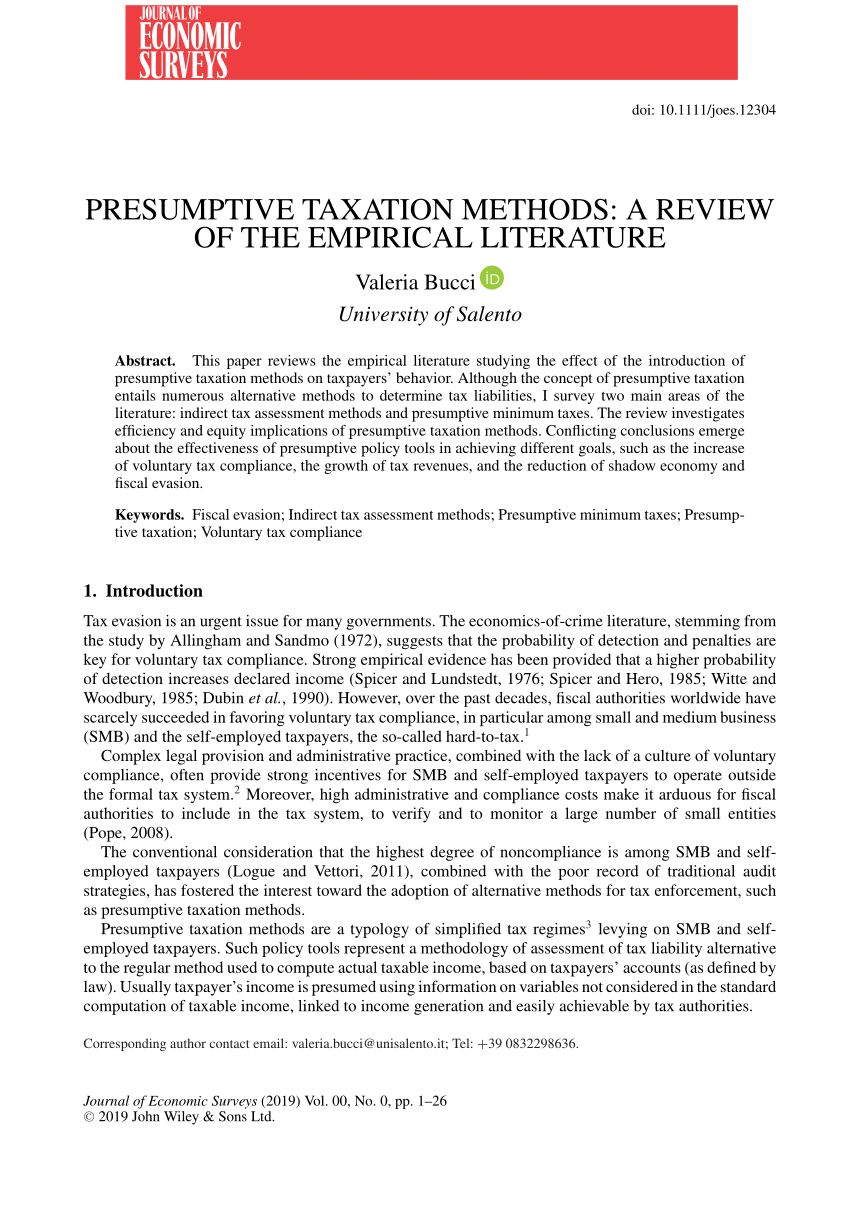

Pdf Presumptive Taxation Methods A Review Of The Empirical Literature

Accounting Principles That Are Essentials To Understand

Pdf Effect Of Taxation On Dividend Policy Of Quoted Deposit Money Banks In Nigeria 2006 2015

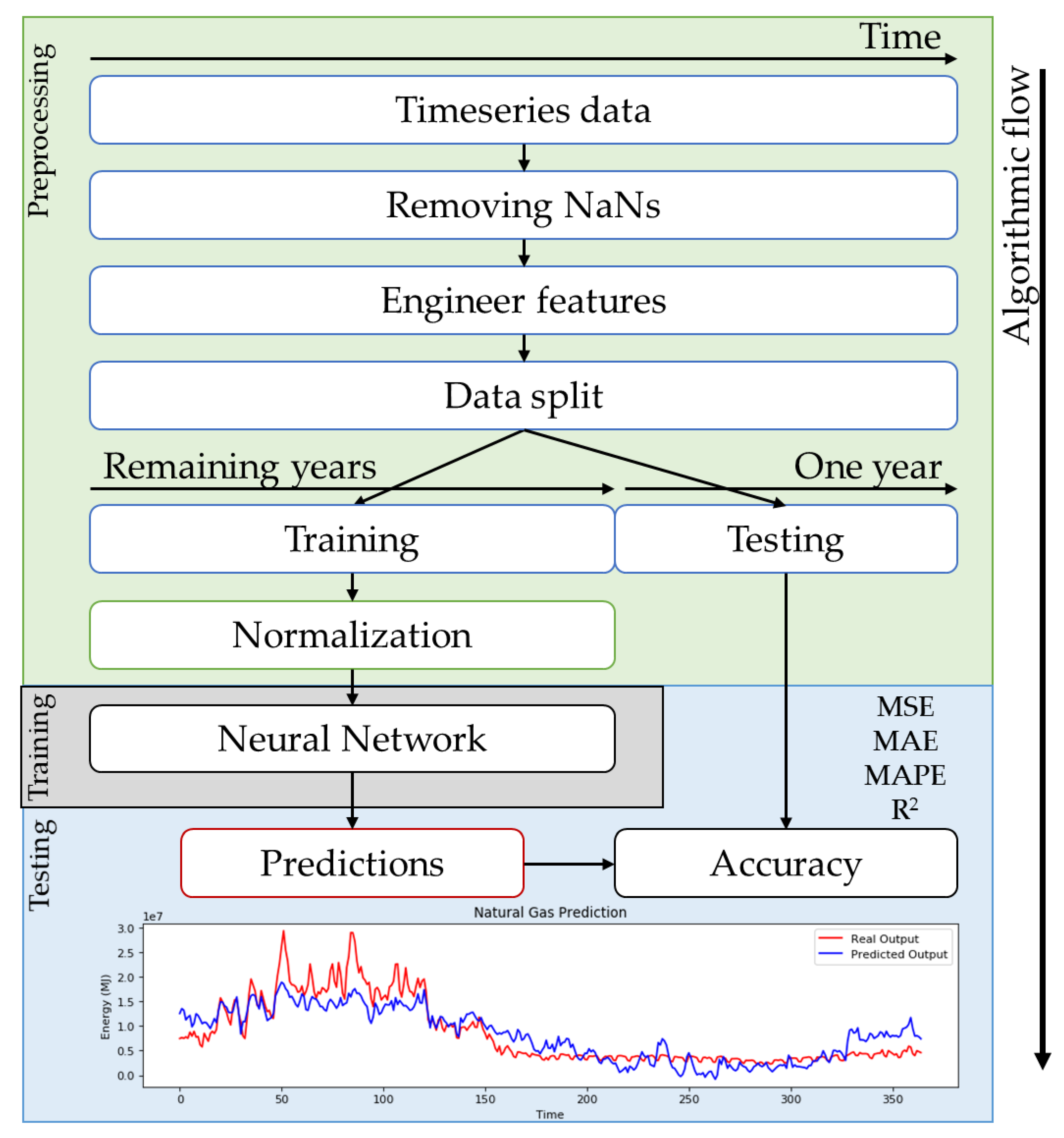

Sustainability Free Full Text Application Of Artificial Neural Networks For Natural Gas Consumption Forecasting Html

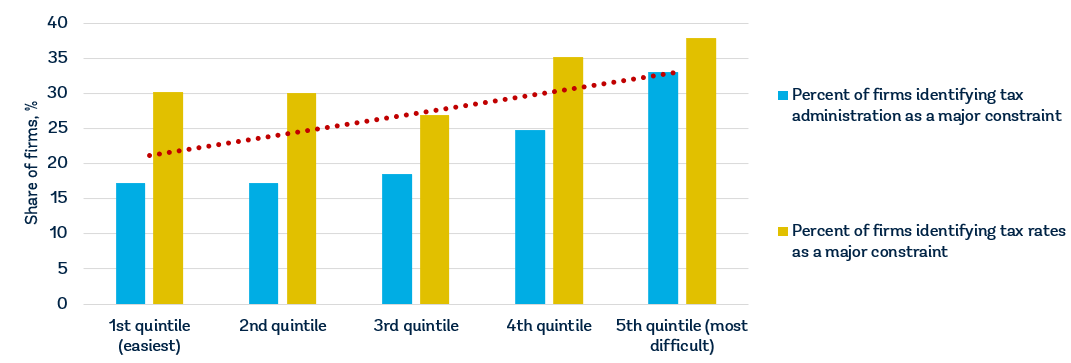

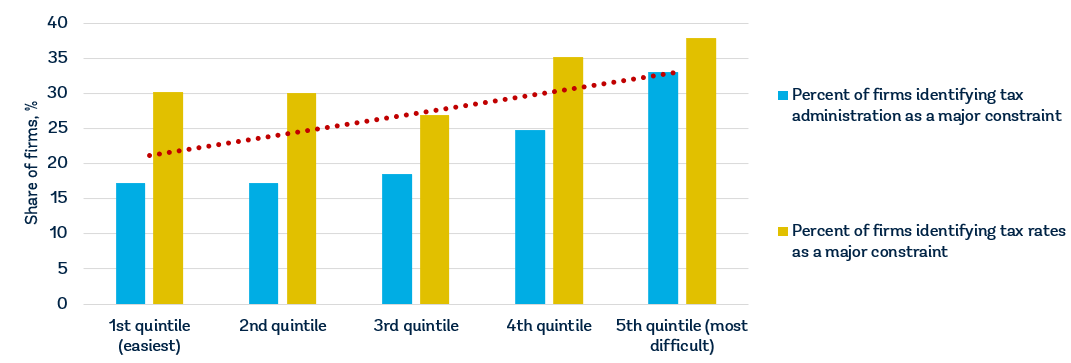

Why It Matters In Paying Taxes Doing Business World Bank Group

Pdf Presumptive Taxation Methods A Review Of The Empirical Literature

Solved Tiililji Problem 19 Of 23 13 14 The Number Of Shares Chegg Com

Purchasing Power Parity And The Real Exchange Rate In Imf Staff Papers Volume 2002 Issue 002 2002

Budget 2022 Gst Proposals May Tight Itc Claims For Suppliers In 2022 Budgeting Proposal Tax Credits

Pdf An Analysis Of Issues Relating To The Taxation Of Cryptocurrencies As Financial Instruments

Comments

Post a Comment